Pvm Accounting Fundamentals Explained

Wiki Article

Not known Details About Pvm Accounting

Table of ContentsLittle Known Questions About Pvm Accounting.Facts About Pvm Accounting UncoveredExcitement About Pvm Accounting7 Simple Techniques For Pvm AccountingSome Known Details About Pvm Accounting Unknown Facts About Pvm AccountingThe 7-Minute Rule for Pvm AccountingExamine This Report about Pvm Accounting

Among the primary reasons for carrying out accounting in building and construction projects is the need for financial control and management. Building jobs usually need substantial investments in labor, materials, equipment, and various other resources. Proper audit allows stakeholders to check and manage these monetary sources successfully. Bookkeeping systems give real-time insights into task prices, profits, and success, enabling job managers to without delay identify prospective problems and take rehabilitative activities.

Audit systems allow business to keep an eye on money circulations in real-time, making certain sufficient funds are available to cover expenditures and meet financial obligations. Effective capital management helps avoid liquidity dilemmas and keeps the task on track. https://hearthis.at/leonel-centeno/set/pvm-accounting/. Building jobs go through different financial requireds and reporting requirements. Proper audit guarantees that all monetary transactions are tape-recorded properly and that the project adheres to accounting criteria and legal agreements.

8 Easy Facts About Pvm Accounting Explained

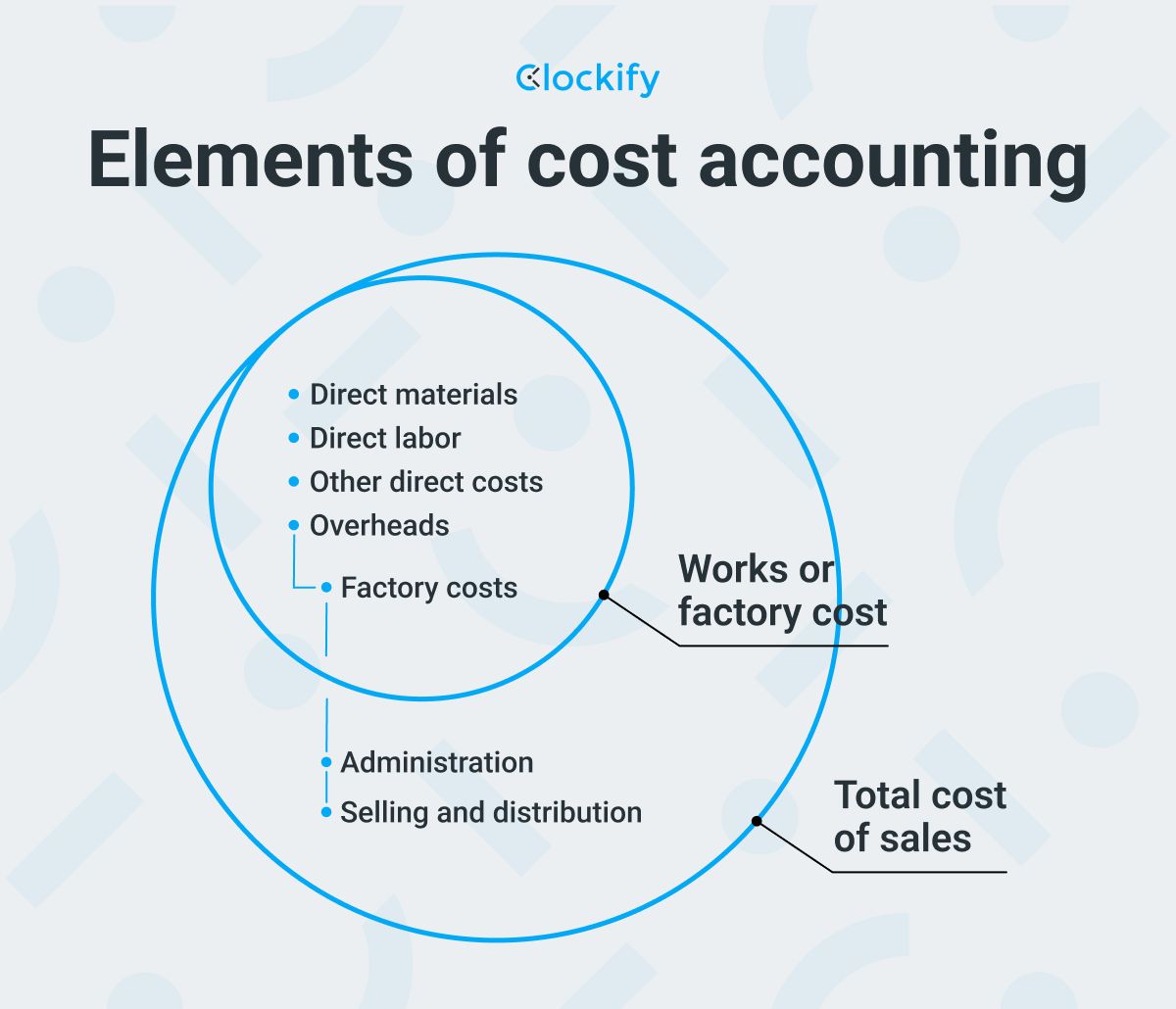

This decreases waste and boosts task effectiveness. To better understand the importance of bookkeeping in construction, it's also necessary to differentiate between construction monitoring bookkeeping and project management accountancy. mainly focuses on the economic elements of the construction business as a whole. It manages overall financial control, budgeting, capital management, and monetary coverage for the whole organization.It focuses on the financial aspects of individual building and construction tasks, such as cost estimation, expense control, budgeting, and capital management for a particular task. Both types of accountancy are important, and they match each various other. Building and construction monitoring audit makes certain the firm's financial wellness, while task monitoring accounting makes sure the financial success of individual tasks.

Pvm Accounting Can Be Fun For Anyone

A crucial thinker is required, that will certainly function with others to choose within their areas of responsibility and to boost upon the locations' work processes. The position will communicate with state, college controller team, university department team, and academic researchers. This individual is expected to be self-directed once the initial discovering curve relapses.

Some Known Details About Pvm Accounting

A Building and visit the website construction Accountant is responsible for managing the financial facets of building tasks, consisting of budgeting, cost monitoring, monetary reporting, and conformity with regulatory demands. They work closely with project managers, service providers, and stakeholders to make certain precise economic documents, cost controls, and timely repayments. Their competence in construction accountancy concepts, job costing, and economic analysis is vital for efficient economic administration within the construction industry.

Some Known Details About Pvm Accounting

Payroll taxes are tax obligations on an employee's gross salary. The earnings from pay-roll taxes are utilized to money public programs; as such, the funds gathered go directly to those programs instead of the Internal Revenue Solution (IRS).Keep in mind that there is an additional 0.9% tax obligation for high-income earnersmarried taxpayers that make over $250,000 or solitary taxpayers making over $200,000. There is no employer match for this added tax. Federal Unemployment Tax Obligation Act (FUTA). Earnings from this tax go toward government and state unemployment funds to aid employees that have lost their work.

Pvm Accounting Things To Know Before You Buy

Your down payments have to be made either on a monthly or semi-weekly schedulean political election you make before each calendar year (construction accounting). Month-to-month repayments - https://pvmaccount1ng.carrd.co. A month-to-month payment needs to be made by the 15th of the following month.So deal with your obligationsand your employeesby making complete payroll tax obligation payments promptly. Collection and repayment aren't your only tax obligation obligations. You'll also have to report these quantities (and various other information) on a regular basis to the internal revenue service. For FICA tax obligation (along with federal revenue tax), you have to finish and file Type 941, Employer's Quarterly Federal Tax obligation Return.

The 4-Minute Rule for Pvm Accounting

Every state has its own unemployment tax (called SUTA or UI). This is because your firm's market, years in service and unemployment background can all establish the portion used to compute the amount due.

The 8-Minute Rule for Pvm Accounting

The collection, remittance and coverage of state and local-level tax obligations depend on the federal governments that levy the taxes. Plainly, the topic of pay-roll tax obligations entails lots of moving components and covers a large range of audit knowledge.This site makes use of cookies to improve your experience while you browse with the website. Out of these cookies, the cookies that are categorized as required are saved on your browser as they are vital for the working of standard capabilities of the web site. We also make use of third-party cookies that aid us examine and recognize how you utilize this website.

Report this wiki page